Indicators on Pvm Accounting You Should Know

Indicators on Pvm Accounting You Should Know

Blog Article

Top Guidelines Of Pvm Accounting

Table of Contents8 Easy Facts About Pvm Accounting DescribedThe Best Guide To Pvm AccountingPvm Accounting Can Be Fun For AnyonePvm Accounting for BeginnersA Biased View of Pvm AccountingPvm Accounting - An Overview

Manage and handle the production and approval of all project-related payments to customers to promote excellent communication and stay clear of issues. construction accounting. Make sure that ideal reports and documentation are submitted to and are upgraded with the IRS. Ensure that the bookkeeping procedure follows the law. Apply required building and construction accountancy criteria and procedures to the recording and coverage of construction activity.Understand and maintain typical expense codes in the audit system. Communicate with various funding agencies (i.e. Title Business, Escrow Company) relating to the pay application procedure and needs required for settlement. Take care of lien waiver dispensation and collection - https://linktr.ee/pvmaccount1ng. Monitor and fix financial institution issues consisting of cost abnormalities and examine distinctions. Aid with applying and keeping inner financial controls and procedures.

The above declarations are intended to describe the basic nature and degree of work being carried out by people assigned to this classification. They are not to be construed as an extensive checklist of obligations, tasks, and abilities needed. Personnel might be needed to execute obligations beyond their normal duties from time to time, as required.

Not known Details About Pvm Accounting

You will aid support the Accel team to guarantee distribution of successful on time, on budget plan, projects. Accel is looking for a Construction Accounting professional for the Chicago Workplace. The Building Accounting professional carries out a selection of accounting, insurance policy compliance, and project management. Works both separately and within details departments to maintain financial records and ensure that all documents are maintained current.

Principal responsibilities include, however are not restricted to, handling all accounting functions of the business in a prompt and precise fashion and giving reports and schedules to the business's CPA Firm in the prep work of all economic declarations. Ensures that all bookkeeping procedures and features are taken care of accurately. In charge of all financial records, pay-roll, banking and everyday procedure of the bookkeeping feature.

Prepares bi-weekly test balance reports. Functions with Task Managers to prepare and post all monthly invoices. Procedures and problems all accounts payable and subcontractor repayments. Generates monthly recaps for Employees Payment and General Liability insurance costs. Creates regular monthly Job Price to Date records and working with PMs to resolve with Job Supervisors' budget plans for each task.

Some Ideas on Pvm Accounting You Should Know

Proficiency in Sage 300 Building and Property (formerly Sage Timberline Office) and Procore building and construction management software application an and also. https://www.ted.com/profiles/46928939. Have to likewise be proficient in other computer system software program systems for the preparation of reports, spread sheets and various other bookkeeping evaluation that may be needed by monitoring. Clean-up bookkeeping. Have to have solid organizational skills and capability to focus on

They are the economic custodians who make sure that building and construction projects remain on budget plan, abide by tax regulations, and preserve monetary openness. Construction accountants are not just number crunchers; they are critical companions in the building procedure. Their key duty is to take care of the economic elements of building and construction tasks, making certain that sources are alloted effectively and economic threats are lessened.

Excitement About Pvm Accounting

They work closely with task managers to develop and monitor spending plans, track Related Site costs, and forecast economic needs. By maintaining a limited hold on project funds, accounting professionals assist avoid overspending and financial troubles. Budgeting is a foundation of successful building projects, and building and construction accounting professionals are important in this respect. They develop comprehensive spending plans that include all project costs, from materials and labor to permits and insurance policy.

Construction accountants are skilled in these laws and make certain that the project complies with all tax obligation needs. To succeed in the duty of a construction accountant, people require a strong educational structure in accounting and financing.

In addition, certifications such as State-licensed accountant (CPA) or Certified Building Market Financial Expert (CCIFP) are extremely concerned in the industry. Functioning as an accounting professional in the construction industry includes a distinct set of difficulties. Building and construction jobs often involve tight target dates, transforming laws, and unanticipated expenses. Accountants must adapt promptly to these difficulties to keep the job's financial health undamaged.

The Of Pvm Accounting

Ans: Building and construction accounting professionals create and keep an eye on budgets, determining cost-saving possibilities and making sure that the job stays within budget plan. Ans: Yes, building and construction accountants take care of tax conformity for building and construction jobs.

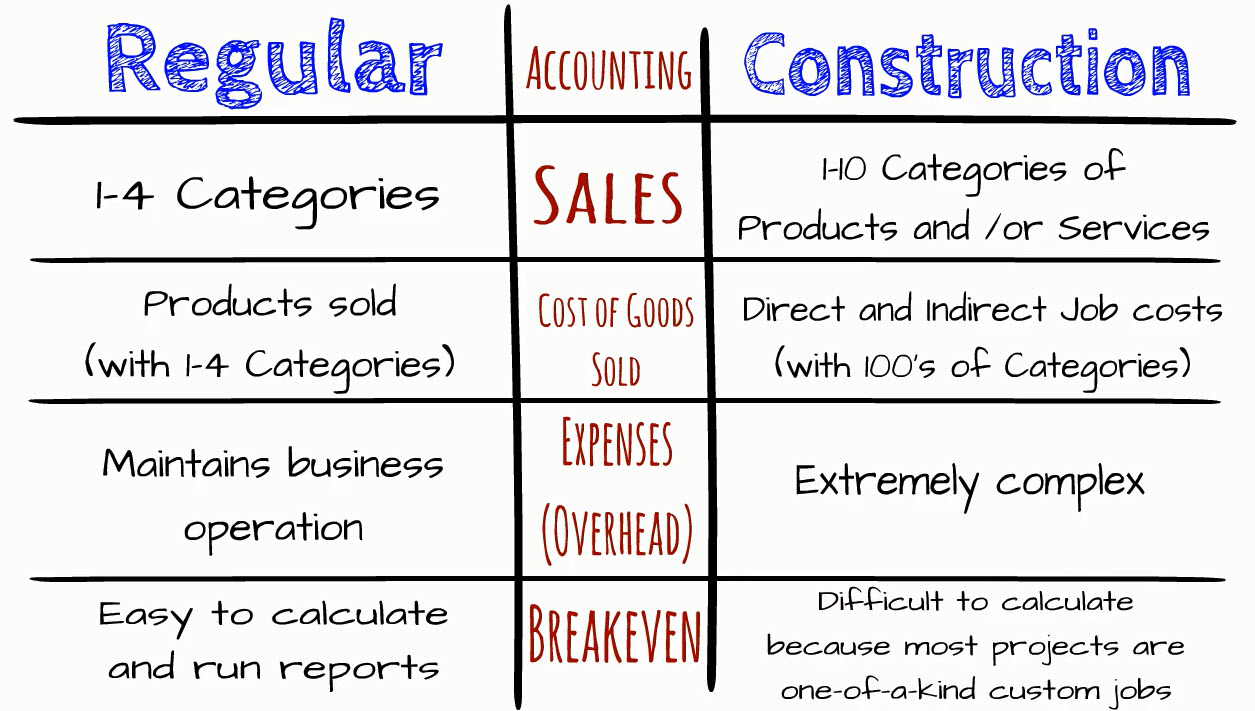

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make tough choices among several financial options, like bidding on one job over an additional, selecting funding for materials or tools, or establishing a project's revenue margin. In addition to that, construction is an infamously unpredictable industry with a high failing price, slow time to repayment, and irregular capital.

Normal manufacturerConstruction company Process-based. Manufacturing involves duplicated processes with conveniently identifiable prices. Project-based. Production calls for different procedures, materials, and devices with differing expenses. Fixed place. Manufacturing or manufacturing happens in a solitary (or numerous) controlled locations. Decentralized. Each project occurs in a new place with differing website conditions and special challenges.

The Best Guide To Pvm Accounting

Long-lasting connections with suppliers alleviate arrangements and enhance effectiveness. Irregular. Regular usage of different specialized professionals and providers affects efficiency and cash flow. No retainage. Settlement gets here in complete or with normal settlements for the full agreement quantity. Retainage. Some section of repayment may be withheld up until project completion also when the service provider's job is completed.

While standard manufacturers have the benefit of controlled atmospheres and maximized production procedures, building and construction companies have to regularly adjust to each new project. Also rather repeatable projects need alterations due to website conditions and other variables.

Report this page